Nice to see the markets bounce higher. It’s been about 7 weeks. Most US major stock market indexes rose over 6% last week.

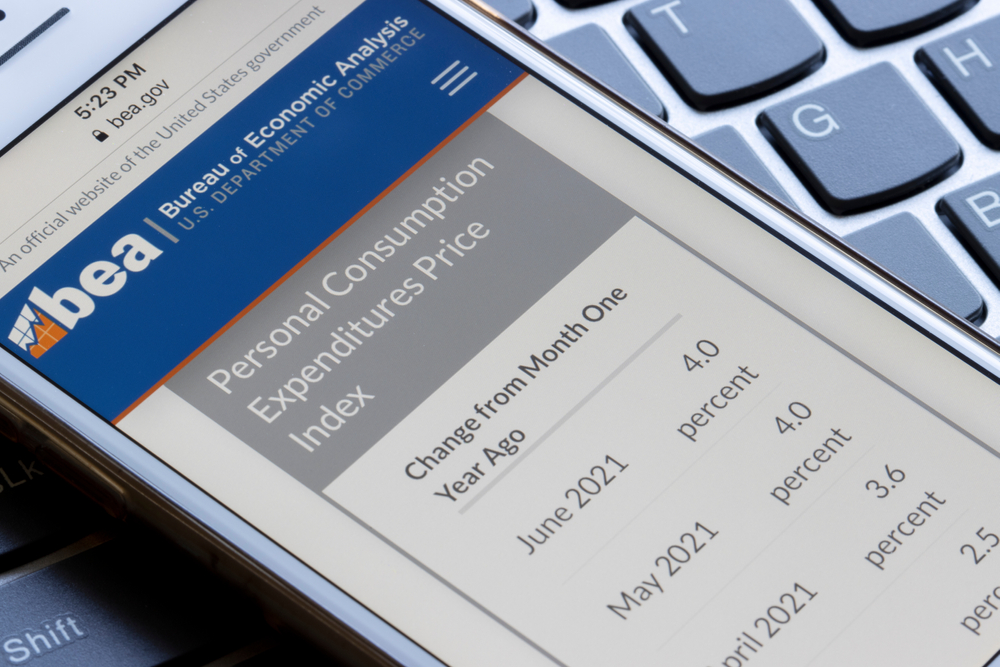

Part of the reason for the bounce is the Federal Reserve’s preferred inflation gauge, the Core Price Consumption (PCE) index was reported increasing 4.9% in May, down from 5.2% in April. A small victory in my mind because the PCE does NOT include food and energy when calculating inflation. So why is the PCE still the Federal Reserve’s primary inflation index of focus?

I noticed this morning that President Biden and Federal Reserve Chair Powell will meet today to discuss inflation. Apparently, Biden has a 3-point plan. I just hope its better than the prior plan to increase the amount of available oil from the United States Strategic Oil Reserve. That, as of now, has not helped.

This morning the price of oil is again rising, hitting $118.69. $5/gallon regular gas may be very soon. I’ve been paying over $5/gallon for Super for a few weeks.

Oil has its hands in everything. Whether oil is used to directly manufacture a product, or used to transport the product for retail distribution, it’s importance is very significant. The more that we learn about alternative sources of energy, the more obvious it becomes that it may take some time to replace a significant percentage of fossil fuels.

Markets Last Week

The stock market bounce was mostly in the US as the Dow, S&P 500, the Nasdaq, and Russell 2000 all moved higher by over 6%. Foreign stocks did rise (however 3.51%) and emerging market stocks rose .92%.

Bond yields retreated last week with the 10-Year finishing the week with a yield of 2.75% and the 2-Year @ 2.50%.

Other tidbits to note:

- This coming Friday is “jobs” Friday. It is estimated we created 320K jobs last month, down from 428K the month prior. The unemployment rate is an incredible 3.6%. This report will be worth examining to see what industries are hiring and which have slowed.

- Medicare Part B premiums may decrease next January. For 2022, the part B premium increased from $148.50/month to $170.19. A huge increase mostly attributable to the statutory requirement to prepare for potential expenses, such as spending trends driven by Covid and the uncertain pricing of Aduheim, the new drug to treat Alzheimer’s disease. The projection of the Aduheim drug was $56K per year per person, which is now is down to $26,200. This decrease is the reason the Centers for Medicare Services (CMS) is projecting a consumer cost decrease. Hopefully this happens!

- The Federal Estate Tax exemption for 2022 is $12,060,000 per person. If Congress does not act, the exemption will decrease to $5,000,000 per person beginning in 2026. As this is somewhat old news, for some taxpayers, gifting assets prior to the decrease may make a lot of sense.

- IRS interest rates have increased. If you owe additional tax over and above what you paid, the IRS will levy a 5% cost. If you are owed a refund, you will also receive 5% interest however only after the refund is outstanding for over 45 days.

During our typical client investment & planning reviews, we’ve been discussing inflation, interest rates, the economy, the Russia/Ukraine war, portfolio positioning and more. If anyone you know has concerns and would like to use me as a sounding board, please feel free to pass on my information. I welcome the opportunity to help as many people as possible, even if they are not clients.